Swiss Public Takeover Law in a Nutshell

The term public tender offer (or public takeover offer) is defined as the public offer to all shareholders of a listed company to sell their shares at a price determined in the offer.

The term public is not clearly defined in any statute or any of the applicable ordinances. The Federal Act on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading on 19 June 2015 (Financial Market Infrastructure Act, "FMIA") merely refers to the fact that a tender offer is made "publicly to the holders of shares or other equity securities" (art. 2 lit. i FMIA). In practice, this is usually assumed when an offer is either addressed to a large number of people or published in a way that a large number of people can be reached (e.g. via publication in electronic or print media). In any case, it is not relevant how many addressees are actually reached.

The term equity securities includes in particular shares, participation certificates or profit-sharing certificates. However, conversion or option rights, or instruments, respectively, that allow for such conversion or option rights (e.g. convertible bonds) are covered as well.

One of the essential characteristics of a tender offer is that shareholders are free to decide whether to tender their shares at the offered price or to keep them. Accordingly, transactions in which the transfer of shares is mandatory for the shareholders (e.g. in a merger, after the respective resolution is passed by the shareholders meeting) are not considered as tender offers in the above sense.

The offeror is the party that submits the offer. During the tender procedure, an offeror is subject to various obligations. For example, the offering prospectus must be approved by an inspection authority and, subsequently, be published; the offerees must be treated equally (cf. with relation to the Best Price Rule question 8), transactions relating to participations rights of the target company as well as relating to securities offered for exchange have to be reported to the Takeover Board; and intermediate and final results need to be published.

Public buyback offers of a company's own listed equity securities are also considered to be public tender offers as well. In contrast to regular public tender offers, such public buyback offers are, however, subject to simplified rules. A public buyback offer has under certain circumstances, prior to its execution, only to be reported to the Takeover Board.

The Swiss public takeover law is set forth in articles 125 to 141 of the Financial Market Infrastructure Act the corresponding Ordinance on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading of 25 November 2015 (Financial Market Infrastructure Ordinance, "FMIO") and the ordinances of the Swiss Financial Supervisory Authority (FINMA Financial Market Infrastructure Ordinance, "FMIO-FINMA") and the Takeover Board (Takeover Ordinance, "TOO") as well as four Circulars of the Takeover Board.

All current legal texts and their abrogated versions can be downloaded here.

The statutory provisions primarily aim at providing for fair and transparent conditions in a takeover situation as well as guaranteeing equal treatment of owners of equity securities. The objective is to steer the Swiss market for corporate control, i.e. takeovers of companies listed in Switzerland, and to provide for fair and transparent conditions and ensure a fair procedure for the benefit of the owners of equity securities.

The provisions on public tender offers in the Financial Market Infrastructure Act, and the implementing ordinances thereto, apply to all public tender offers for holdings in companies with registered office in Switzerland whose equity securities are listed in whole or in part of Switzerland,or in companies with registered office abroad whose equity securities are mainly listed in whole or in part of Switzerland.

In addition to the offeror (as well as a potential competing offeror), the target company and the Takeover Board (see question 15), persons or companies collaborating with the offeror and qualified shareholders of the target company might be involved or participate in a public tender procedure.

The conduct of persons collaborating with the offeror might cause an offer obligation. Individuals and legal entities collaborating with the offeror are subject to various duties: They have to report to the Takeover Board on a daily basis transactions in participation rights of the target company and transactions in securities offered for exchange. Furthermore, their transactions in participation rights of the target company are relevant for compliance with the Best Price Rule. Persons collaborating with the offeror are only under the obligation to pay the offer price if so provided by the public tender offer.

In the proceeding before the Takeover Board, qualified shareholders are in a special position. A shareholder holding at least 3% of the voting rights of the target company is considered to be a qualified shareholder. In contrast to a non-qualified shareholder, such shareholder might constitute itself as party to the proceeding, file applications, object or lodge a complaint.

The Swiss takeover law distinguishes two types of public tender offers, which are generally governed by the same rules but remain subject to specific provisions that differ significantly: Mandatory tender offers (see questions 7 and 8) and voluntary tender offers (see question 10). The decisive feature is whether the offeror is obliged by law to launch a public tender offer or whether it does so voluntarily.

Besides, a public tender offer can be classified differently depending on its specific:

- Partial-/ fulltender offer: This designation indicates how many equity securities the offeror is willing to acquire under the public tender offer. In the event of a full tender offer, the offeror is willing to acquire all publicly held equity securities. In a partial offer, however, the provider wishes to purchase only a part of the publicly held equity securities. A partial offer is only permitted in case of a voluntary offer and if the acquisition does not cause an offer obligation.

- Cash- / exchange offer: The distinction is made on the basis of the type of settlement of the offer price. In a cash offer, the offer price will be paid exclusively in cash. In an exchange offer, the acquisition of equity securities takes place in exchange for equity securities of the offeror or another company or other securities. Further, a mixed offer is also conceivable. Here, a part of the compensation is settled in cash, the other part with securities. In case of a mandatory tender offer designed as an exchange offer, a cash alternative must be offered. In a voluntary offer, a cash alternative is usually not required.

- Initial- / competing offer: This distinction bases on the chronological order of several tender offers for the equity securities of the same target company. The initial offer is the public offer that was first launched. It is also referred to as the previous offer. The competing offer, in contrast, aims against an existing public offer and attempts to prevent its success. In order to ensure the freedom of choice in case of a competing offer, the respective offer periods are coordinated by the Takeover Board.

- Friendly offer / hostile offer: This classification shows how the offeror is perceived by the target company, in particular its board of directors. In a friendly public tender offer, the target company's board of directors recommends to the offerees to accept the offer. The established contact between the offeror and the target company prior to the public offer is also typical for a friendly offer. The offeror and the target company usually sign a so-called transaction agreement. Therein, the offeror commits to the cornerstones of the public tender offer (e.g. offer price, terms, etc.) and the target company guarantees to support the offeror. In the event of a hostile offer, however, the target company resists the offeror and tries to prevent its takeover. Consequently, the board of directors of the target company usually recommends to the offerees to reject the tender offer.

Whoever acquires, directly, indirectly or acting in concert with third parties, equity securities which, in addition to equity securities already owned, exceed the threshold of 33 1/3% of the voting rights of a target company (calculated based on the total number of voting rights registered in the commercial register), is generally under the obligation to make an offer to acquire all listed equity securities of that company.

Such obligation to launch a tender offer is primarily triggered by direct acquisitions by the offeror of equity securities of a target company. Furthermore, an offeror is also obliged to make an offer if he acquires equity securities of a target company indirectly, i.e. via a trustee, a controlled company or otherwise, thereby acquiring the respective voting rights for these equity securities.

In addition, the obligation to make an offer can also be triggered by persons acting in concert with third parties or as an organized group (e.g. by coordinating the exercise of their voting rights) in order to obtain the control of a company, if their combined voting rights exceed the threshold of 33 1/3%.

The mandatory tender offer is subject to the following requirements:

Full offer: Mandatory tender offers must refer to all listed equity securities of the target company, i.e. any listed shares and participation certificates (so-called Partizipationsscheine or Genussscheine) of the target company.

Minimum price: In order to prevent the obligation to submit an offer from being undermined by an unacceptable low bid, a mandatory tender offer must be made at a minimum price. The offer must be made at no less than the higher price of the following: a) the stock exchange price (i.e. the price corresponding to the volume-weighted average price of all on-exchange transactions executed during the 60 trading days prior to the publication of the offer or the pre-announcement, as the case may be) or b) the highest price for equity securities of the target company paid by the offeror in the twelve preceding months. The possibility to pay shareholders with major participations a higher price (so called control premium) before making the public tender offer and thereby build up its participation beforehand was abolished by the revision of the applicable provisions that entered into force on 1 May 2013.

Best Price Rule: Pursuant to the so-called Best Price Rule, the offeror is obliged to offer to all shareholders of the target company the same price as of the publication of the offer. If, as of the date of publication or within six months after the expiration of the additional acceptance period (see below question 11), the offeror or a person acting in concert with the offeror acquires additional shares of the target company at a higher price than offered, the offeror is obliged to offer that better price to all addressees of the offer.

Conditions: As a rule, mandatory tender offers must not be subject to conditions. As an exception, a mandatory tender offer may be conditional in case of good cause, e.g. if the change of control requires official authorization.

Compensation: A mere exchange offer (compensation by way of other equity securities in lieu of cash payment) is not permissible in a mandatory tender offer. In case of tendering equity securities as a way of compensation, the offeror is obliged to tender cash payment alternatively.

By implementing a so-called opting-out-clause in the articles of incorporation, a target company may waive the obligation to make an offer for any purchaser of shares, even when the purchaser passes the threshold of 33 1/3%. By way of an opting-up-clause it is also possible to raise the relevant threshold for the obligation to make an offer in the articles of incorporation from 33 1/3% up to 49% of the voting rights.

An opting-out/opting-up may be introduced in the articles of incorporation any time. Takeover law, however, does only allow for the introduction if the shareholders have transparently been informed in advance about the introduction and the consequences of an opting-out/opting-up and the majority of the minority shareholders have agreed to the introduction.

An opting-out/opting-up can be designed both general and selective. A general opting-out/opting-up releases every shareholder from an offer obligation, also unknown shareholders at the time of the introduction in the articles of incorporation. A selective opting-out/opting-up, however, exempts only recognized, i.e. explicitly stated or implicitly meant parties and/or transactions from the offer obligation.

Tender offers which do not qualify as mandatory tender offers are considered to be voluntary tender offers and generally are not subject to the restrictions applicable to mandatory tender offers. A voluntary tender offer may be a so-called partial offer, i.e. it may be limited to only a certain number of shares of the target company. Voluntary tender offers may be subject to conditions and the offer price can be set freely subject to few exceptions (Best Price Rule and ratio between prices for different types of equity securities). The voluntary tender offer may also be an exchange offer only, i.e. the equity securities of another company may be the only compensation offered in exchange for the equity securities of the target company.

However, if in the course of a voluntary tender offer the threshold of 33 1/3% is exceeded due to an acquisition; the offer must comply with additional rules generally applicable to mandatory tender offers. In particular, such an offer must apply to all listed equity securities of the target company and comply with the minimum price requirements. Voluntary tender offers can in general be subject to conditions. However, if an offeror exceeds the required threshold for a mandatory tender offer by acquiring equity securities of the target company during the offer period but outside his voluntary tender offer, he must abstain from those conditions that are not permissible in a mandatory tender offer.

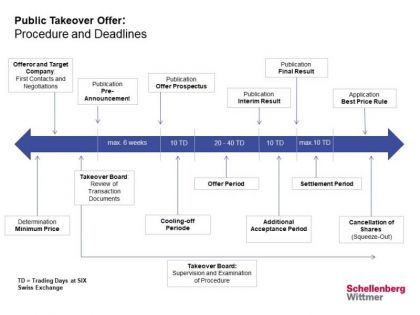

The graphic below illustrates the process of a public tender offer, including the statutory deadlines in case of a friendly tender offer. In the event of a hostile offer or a competing offer the course of the procedure may vary significantly.

Before the public is informed about the public offer, contacts are established between the offeror and the target company and in particular also between the offeror and the Takeover Board. The Takeover Board examines all public tender offers and actively guides the entire takeover process. It is recipient of all inputs and documents that need to be published during the takeover process.

As a rule, the first publicly visible action of the offeror is the publication of the pre-announcement. The publication of the pre-announcement is not required by law; nevertheless, it has different legal effects. In particular, the appointment sets the record date for the calculation of the minimum price. Subsequently, the offeror has to publish the offering prospectus. The offering prospectus must contain all information to allow the offeree (the holders of equity securities of the target company) to form an objective opinion on the public tender offer. It usually contains information on the persons involved, the financing of the offer, conditions, the offeror's plans with the target company after the completion of the public tender offer as well as a progress schedule of the entire public offer. The offering prospectus is reviewed by the Takeover Board for completeness and accuracy.

The board of directors of the target company must publish its opinion on the tender offer. This publication can either be made in the offering prospectus of the offeror (in case of a friendly offer) or as a separate publication during the offer period (in case of a hostile offer).

After the publication of the offering prospectus, the grace period follows and generally lasts for ten trading days. Its purpose is to ensure that the offering prospectus fulfills the legal requirements. Only in the adjoining offer period the tender offer may be accepted by the offeree and the target company's equity securities tendered to the offeror. This is usually done by notifying the bank of the offeree. The offer period usually lasts for 20 trading days, but may be extended to 40 trading days. Thereafter, the offeror has to publish the interim result and thus explain, in particular, whether the takeover offer was successful or not. In the latter case, the offeror may withdraw from the public tender offer and the proceeding is canceled. If, however, the offer was successful, or the offeror nevertheless wants to complete the public tender offer, the grace period is extended after the publication of the interim result. During this period of ten trading days, the offerees have once more the opportunity to tender their shares to the offeror. After the extended grace period has expired, the offeror has to publish the final result and to complete the exchange (equity securities against offer price). Upon completion, the shares of the target company are transferred to the offeror and the tendering offerees receive the offer price on their bank or custodian account.

If the offeror after completion of the public takeover offer is not the sole shareholder of the target company, it may under certain conditions declare the outstanding equity securities of the target company to be invalid (squeeze-out according to stock exchange law) or strive to a squeeze-out merger) (see question 16).

During a public takeover procedure the board of directors of the target company often has a fairness opinion prepared by investment banks or financial advisors. A fairness opinion tries, using various valuation methods (especially discounted cash flow method and transaction multiples), to determine a value range for the participation rights of the target company. Consequently, the aim is not to calculate an exact value. Nevertheless, it is apparent from the fairness opinion whether the offer price appears to be appropriate or not. The fairness opinion thus helps the offerees in the decision whether they should accept or reject the public tender offer. The fairness opinion is published together with the report of the board of directors.

Only in exceptional cases, the fairness opinion is created as result of a duty. An obligation to create a fairness opinion exists if not at least two members of the board of directors of the target company are free of conflicts of interest. Mostly, the fairness opinion is not created on the basis of this duty but to allow the board of directors to legitimize its own position - either rejects the public tender offer, recommend accepting the public tender offer or non-partisanship.

If a person publicly states to consider the possibility of a tender offer (potential offer) without formally publishing an offer, the so-called put up or shut up rule might come into play. Since such intentions regularly result in an uncertainty in the market, the Takeover Board can this person (potential offeror) oblige to either publish within a specified period an offer for the target company (put up) or to publicly declare not to submit an offer within the next six months or to exceed the threshold that causes an offer obligation (see question 7) (shut up). To do so, the Takeover Board has a wide discretion.

A potential target company may take various measures to limit the influence of an unwanted shareholder and to fend off an unwanted takeover attempt, respectively.

Such defense measures can broadly be divided into two categories:

- Measures taken prior to the publication of a tender offer: Such measures are referred to as "preventive defense measures" and are intended to discourage any interested buyers from attempting to take over the company. Besides factual or contractual defense measures, such preventive measures include in particular statutory defense measures such as transfer restrictions, voting restrictions or qualified quorum and majority requirements. These measures aim to limit the individual shareholders' voting power and, accordingly, the influence of such shareholders on the decision making process of the target company. From a takeover law perspective, such measures are generally permissible if they can be revoked.

- Measures taken after the publication of a tender offer (or its respective pre-announcement): The implementation of such defense measures is only permissible within certain limits unless they were resolved by the shareholders' meeting. Accordingly, the board of directors of a target company cannot decide on any transactions that have significant impact on the target company's assets or liabilities, such as:

- Sale or purchase of assets of more than 10% of the total assets or the total earning power of the target company (scorched earth defense);

- Sale or encumbrance of the assets designated by the takeover offer as being the principal objects of the takeover attempt (crown jewel defense);

- Unusually high severance payments (golden parachutes);

- Issue of new shares from authorized or conditional capital;

- Purchase and sale of treasury shares; or

- Issuance or granting of option rights.

Despite the general prohibition of defense measures after the publication of a public tender offer, the board of directors of a company being targeted by an unfriendly takeover offer may nevertheless take certain measures against an undesirable offer, such as submission of statutory defense measures to vote at the shareholders' meeting, announcement of a planned share buyback, search for a white knight, involving the offeror in a litigation, or generally taking public relations measures. However, the board of directors of the target company must report in advance to the Takeover Board any defense measure it intends to take. In addition, defense measures adopted by the board of directors or the shareholders' meeting that would constitute an obvious violation of Swiss corporate law – in particular measures taken before the publication of the tender offer (or the pre-announcement) – are not permissible.

Public tender offers are subject to supervision of the Takeover Board as well as the Swiss Financial Market Supervisory Authority ("FINMA").

The Takeover Board examines whether the applicable provisions for public tender offers are being complied with. As a rule, the Takeover Board is contacted by the offeror and other parties prior to the publication of the public tender offer or the pre-announcement, respectively, and subsequently accompanies the takeover procedure actively. The Takeover Board issues an order that is published on its website (www.takeover.ch).

The FINMA is the independent supervisory authority in the field of takeover law and acts as appeal body for complaints regarding decisions taken by the Takeover Board. Decisions issued by the FINMA may be challenged before the Federal Administrative Tribunal. Procedures in takeover matters are characterized by extremely short deadlines and generally short proceedings.

After the completion of the public tender offer, the offeror does usually not hold all equity securities of the target company: Not all holders of equity securities want to tender their equity securities to the offeror and others may have no knowledge of the running takeover process at all. However, the offeror has a strong interest in taking over all equity securities and, in particular, to become sole shareholder of the target company. To achieve this, the following options are available to the offeror after completion of the public tender procedure:

- The offeror holds more than 98% of the voting rights of the target company: The Financial Market Infrastructure Act provides in this case that the offeror may, during a short period after completion of the public tender offer, have the remaining equity securities (not only the shares) of the target company be declared invalid by a court, so that the minority shareholders are excluded from the target company (squeeze-out according to stock exchange law). If the offeror's claim is successful, all remaining equity securities of the target company are transferred to the offeror in exchange for payment of the offer price to the excluded holders of equity securities. Thereby, the offeror becomes sole shareholder of the target company;

- The offeror holds between 90% and 98% of the voting rights of the target company: Since the offeror has control over the target company, it can merge the target company with another company it controls. As part of such a merger, minority shareholders can be excluded from the merged company (squeeze-out merger);

- The offeror holds less than 90% of the voting rights of the target company: In this case, there is no direct possibility to push the minority shareholders out of the target company. However, the offeror may also after completion of the public tender offer buy additional participation rights of the company in order to reach the threshold of 90% or 98% of the voting rights, respectively. If this is successful, the offeror may proceed as described above.

Irrespective of these options, a delisting of the target company's participation rights is conceivable. Since such a decision falls within the competence of the board of directors, the offeror only needs to control the target company's board of directors. Despite the fact that the delisting has no direct effect on the legal position of minority shareholders of the target company, they still lose the ability to easily dispose their participation on the stock exchange.